Mobile Banking

Credit union convenience in the palm of your hand.

Download our mobile banking app for convenient access anywhere you go.

Bank instantly

Check balances, make transfers, deposit checks, and pay bills all from your smartphone.

Card Controls & Alerts

Manage your debit or credit card anytime and set up transaction alerts so you’re always in the know about your spending habits.

Locate an ATM or Shared Branch

Find the nearest place to withdraw cash or speak with a representative using the app’s Shared Branch & ATM locator.

So how does Mobile Banking work?

First, enroll in Online Banking if you haven’t already. If you have an Apple or Android device, visit your App Store or Google Play Store and search “Lafayette Federal Credit Union”. Once you download the app, you can log in, view your balance, and more!

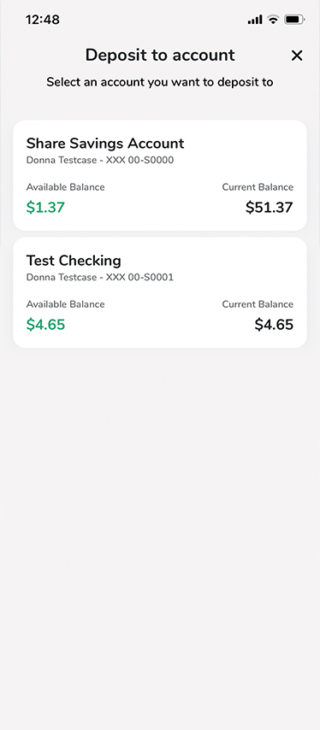

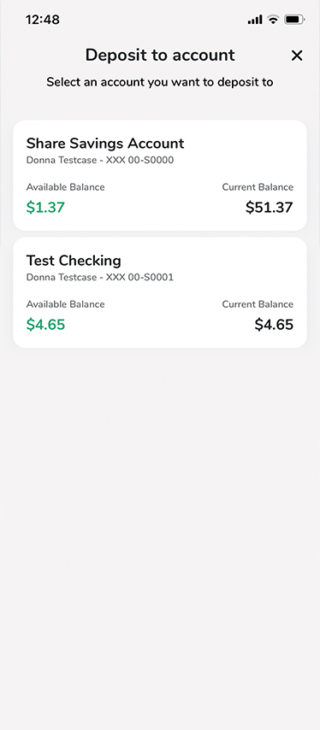

Make a mobile deposit

With Mobile Deposit, you can deposit your checks faster, safer and more conveniently with our mobile app!*

Set up alerts or block your card

Lost your wallet or noticed some suspicious activity in your account? Use the mobile app to block your debit card while we help you straighten things out.

Plus, set up account alerts to monitor every transaction made with your account.

View your transaction history in real time

See your current balance, account information, and your most recent transactions all in one place.

Send money to friends and family

With just a couple clicks, you can send payments to friends, family, and other Lafayette Federal members.

Login using Face ID

Keep your account secured when you set up Face ID, which means you’ll never have to worry about someone accessing your account unless it’s you.

Our members say the nicest things.

I’ve been a happy customer of Lafayette Federal Credit Union for 12 years. I had been banking at [Big Bank] for years, but during the 2008 financial crisis I realized the enormity of their corruption and disregard for their customers. I decided to take my banking business somewhere that I could trust. I was grateful to find LFCU and appreciate the fact that they are a local financial institution that invests in our community. My banking experience with LFCU has been very positive from customer service to my automobile loan to online banking. Because of this I’ve recommended LFCU to several friends and my brother who are now customers!

Cynthia M.Member for 12 Years

We’re always here to answer your questions.

Mobile Banking makes managing your accounts easy. Consider the following:

- When you’re in a store and see a big-ticket item you want, wouldn’t it be nice to be able to check your account balance and make sure you have enough in your account to cover it?

- When you’re waiting around in a doctor’s office or at the DMV or an airport, wouldn’t that be a good time to check and review your transaction history?

- When you’re on vacation, running errands or have no computer access for any other reason and have a bill you forgot to pay from home, wouldn’t it be convenient to be able to make that bill payment from your phone?

- When you can’t make it to a branch, isn’t it convenient to make a deposit via your phone?Suppose you’re going out and realize you’ll need some cash. How great would it be to be able to use your phone to find the closest ATM?

Mobile Banking covers your banking needs 24/7.

No. Our Mobile Banking is free!

All you need is an Online Banking account and a smartphone (iOS/Apple iPhone or Android), a web-enabled device (mobile browser) or a standard mobile device with text capabilities.

If your phone is lost or stolen, don’t worry. Your Mobile Banking access is secured. Your password is never stored on the phone, nor is any other personal information from your Mobile Banking account. Also, your login session always times out automatically after ten minutes of inactivity.

Not finding what you’re looking for? Contact us

Ready to bank on your own time?

Disclosures

*Mobile Deposit is available for select mobile devices. Enroll in Online Banking and download the Lafayette Federal Mobile App. Message and data rates may apply. Subject to eligibility and further review. Deposits are subject to verification and are not available for immediate withdrawal. Deposit limits and other restrictions apply.