Open an Account

At Lafayette Federal, our service speaks for itself.

Open Your Account in Minutes!

You will need the following information in order to complete the application:

Eligibility

Check your eligibility to confirm that you’re in our field of membership.

Personal Identification

Have your government issued ID, driver’s license/State ID, or Passport with current address ready.

Your Address

Make sure to have your physical and mailing address on hand.

Your SSN & Date of Birth

We’ll also need other identifying information such as your Social Security Number and Date of Birth to verify your new account.

You are eligible if…

Residents of Potomac, MD

Persons who live or work in that part of Montgomery County, Maryland, known as Potomac, bounded on the south by the Potomac River from Riley’s Lock Road on the west to Cabin John Parkway on the east, on the east by Cabin John Parkway to the Capital Beltway 495 to Interstate 270, on the north by Shady Grove Road to State Route 28 to State Route 112, and on the west by State Route 112 and Seneca Road to River Road to Riley’s Lock Road to the Potomac River, excluding the military reservation known as the U. S. Navy Ship Research and Development Center, are eligible to join.

Select Residents of Washington, D.C.

Many individuals who live, work, worship or attend school in Washington, D.C. are eligible to become members. Our D.C. charter extends to individuals within certain geographic boundaries per the map below.

We extend our membership to all direct-hire individuals employed by or retired from our Select Employee Groups. Find out if your employer is one of our Select Employer Groups.

We extend eligibility to all members of the Home Ownership Financial Literacy Council (HOFLC). HOFLC is a non-profit corporation created to provide its members with the necessary tools to successfully navigate the path of home ownership. Whether you are a first-time home buyer, veteran, or refinancing your current home, HOFLC has the resources to help you make an informed decision. When you sign up, you get the power of information at your fingertips. With a one-time membership fee of $10, you’ll enjoy the following:

- Articles from reliable resources

- Calculators to help you plan to the penny

Persons who live in Maryland, Washington, D.C. or Virginia are eligible to open an account if they are an existing member or become a member of the American Consumer Council (ACC). The ACC was founded to ensure vital customer needs are met and protected through educating American consumers about the benefits of various products and services and acting as a voice for consumer advocacy and economic wellness in the United States. As an influential organization with more than 160,000 members nationwide, ACC applies marketplace pressure to ensure companies offer safe, reliable products and services that consumers can use, trust, and recommend to their family and friends.

We will take care of your ACC membership when you open your Lafayette Federal account — there’s no fee to you. Simply select “persons who live in Maryland, Washington, D.C. or Virginia” for your eligibility and you’ll have the added benefit of becoming a part of ACC. Learn more about the American Consumer Council.

We extend eligibility to all current members’ immediate family members. This includes: grandparents, parents, spouses, children (including foster and adopted), grandchildren and siblings. Un-remarried spouses of persons who died while employed by any of our eligible organizations are also eligible for membership.

This means that once you become a member, your family members automatically become eligible to join!

Get The Most From Your Credit Union.

At Lafayette Federal Credit Union we serve, support and empower our members by providing products and services from the convenience of our mobile-app, in-person at a branch location, or by calling our contact center. We give you the power to control your accounts wherever you go.

Manage Your Cards Securely

Protecting your card should be simple. That’s why we give our members the tools to add transaction alerts, block your card if you see suspicious activity and more.

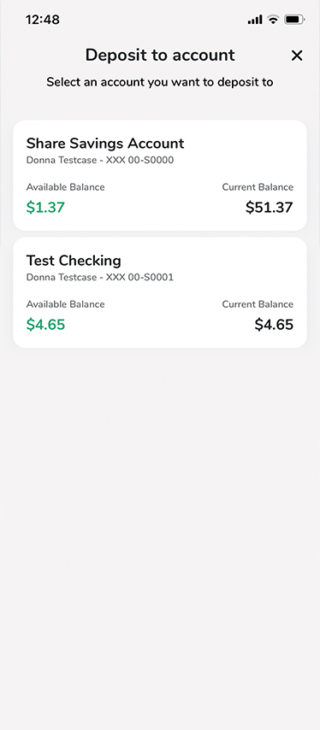

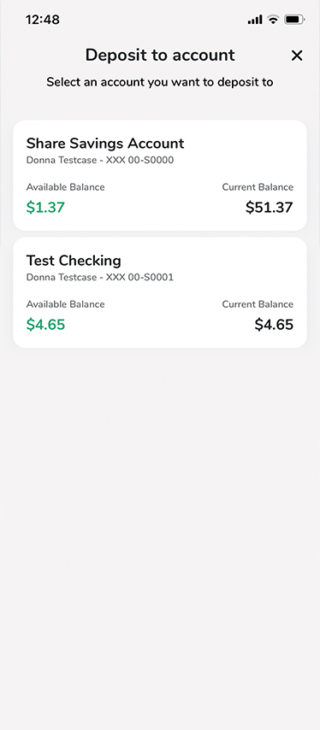

Mobile Deposit

Instead of walking into a branch or visiting a check cashing store, simply deposit your check using our mobile banking app using remote deposit. You can track pending deposits, rejected, or posted checks right from the convenience of your home.

Track Your Weekly Spending

Tracking your expenses should be easy. So, we summarize all of your transactions for you to see whenever you login. Track weekly, monthly, and yearly expenses for budgeting purposes, tax season, savings goals and more.

Move Your Money Quickly

You can move your funds between your Lafayette accounts, send money to family or friends by syncing your phone contacts. send money to yourself at another financial institution securely, withdraw money from another financial institution, transfer funds via wire (fees apply), and more.

Join The Credit Union With Ease!

Find out why we were ranked in Newsweek’s Best Banks of 2023 & 2022.

No daily balance limit fees.

No fees means no fees. We strive to give money back to our members in the form of high yield products designed to work for you. See our list of high-yield rates and low interest fees here: View Our Rates

Minimum $50 to Open an Account

Open your new account with ease. Every account at Lafayette Federal Credit Union helps you to grow financially. Your $50 minimum deposit goes into your Share Savings account and you can start earning interest on your deposits today.

Earn Higher Dividends With Our High-Yield Accounts.

Choose a high-yield account from checking, certificates, savings and more. Choose accounts that reward you and leave fee driven accounts behind. View Our Accounts.

Easily Add Your Card to Mobile Wallet.

Link your card with popular mobile payment platforms like Zelle, Cash App, and Venmo. Enjoy the convenience of transferring money to friends and family, splitting bills, and making secure peer-to-peer transactions instantly.

What is the difference between a credit union and a bank?

The credit union difference is felt everywhere.

-

Type of Organization

Type of Organization

-

Who can join

Who can join

-

Invested in

Invested in

-

Deposits federally insured

Deposits federally insured

-

Governance

Governance

-

Interactions with like financial institutions

Interactions with like financial institutions

Lafayette Federal Credit Union

-

Type of Organization

Not-for-profit – Fewer fees, lower rates

As a not-for-profit financial cooperative, we return our profits to our members in the form of better rates, lower fees and greater service.

-

Who can join

Members

Lafayette Federal’s membership is open to anyone we serve, including the family of eligible members.

-

Invested in

Community Members

We serve the needs of our membership and community by investing our non-interest income and interest from loans in local organizations working to make a difference.

-

Deposits federally insured

NCUA Insured ($250k)

Your deposits are insured by the National Credit Union Administration (NCUA) and are backed by the faith and credit of the United States Government.

-

Governance

Member Owned

Each member can exercise their voting rights to fill seats on the Board of Directors. The directors advocate for membership.

-

Interactions with like financial institutions

Cooperative

Credit Unions are financial cooperatives. That means we work together toward one common goal– helping our members prosper.

Banks

-

Type of Organization

For-profit – More fees, worse rates

Traditional banking institutions primarily focus on generating profits for their shareholders with no added benefits to their customers.

-

Who can join

Customers

You cannot join a bank, but anyone can be a customer.

-

Invested in

Generating revenue

Banks use the income they generate from fees, interest, business accounts and investments to increase their shareholders’ earnings.

-

Deposits federally insured

FDIC Insured ($250k)

At a bank, your deposits are insured by the Federal Deposit Insurance Corporation and are backed by the full faith of the United States Government.

-

Governance

Stakeholder Owned

Banks are governed by their shareholders. Voting rights depend on the number of shares you own leaving regular customers out of decisions.

-

Interactions with like financial institutions

Competitive

Banks are competitive. They compete with one another for your business and see you only as a number.

Anyone can earn with our 2.02% APY³ Checking Account.

Enjoy simple terms and an outstanding rate with our 2.02% APY³ Checking– a premium rate over 28 times higher than the national average.

Disclosures

1APY=Annual Percentage Yield. 2Plus cost of check style selected. 3The high-yield bonus dividend rate of 2.02% APY is for primary checking balances up to $25,000, and is in addition to the base rate of 0.025% APY. Total APY earned is 2.04% APY. Business Checking Accounts are excluded. To earn the 2.02% APY bonus rate, member must maintain at least one (1) qualified direct deposit of at least $500 per month. Qualified direct deposit is a recurring direct deposit of a paycheck, pension, Social Security or other periodic payment of at least $500 into a checking or savings account on a month-to-month basis made by an outside organization or agency. Dividends are compounded and credited quarterly.

The rates and terms shown are effective as of January 1, 2024.

*Based on the national average of 0.07% APY1 for comparable checking account rates as published in the FDIC Weekly National Rates and Rate Caps as of December 18, 2023.

We can’t wait to meet you.

As a member of Lafayette Federal Credit Union, you have access to over 5,000 shared credit union branches and more than 30,000 surcharge-free ATMs nationwide.

Ready to join Lafayette Federal?

Monday-Friday 8:30am – 4:00pm

Audio Response 24/7

301-929-7990

1-800-888-6560 (toll-free)